Estate planning is a crucial topic for families, yet it’s often avoided due to its sensitive nature. Discussing finances, wealth transfer, and inheritance can be uncomfortable, but it’s essential for ensuring that a family’s financial future is secure. Families can feel more prepared and confident by approaching the conversation thoughtfully and with the right mindset. This guide offers actionable steps to make estate planning discussions smoother and more productive.

How to Bring Up Conversations About Estate Planning

Unfortunately, investing 101 is not a mandatory class for most people. If you’re not particularly interested in finance, you can cruise through high school, college, and even the beginning of your adult life with little understanding of the subject. One day, it hits you that you need to start building the future you’ve always wanted for your retirement to look like it does in your dreams.

Jargon is wonderful when it applies to your profession but is not so enduring when it applies to someone else’s. I am surrounded in my family by medical professionals and engineers. So, one can only imagine the conversations around my house flying over the head of a financial planner. However, my industry jargon can confuse clients of financial services. In this blog, I will shed some light on a significant word that gets used quite often but remains shrouded in mystery for some: fiduciary.

Does managing your finances ever feel like navigating a maze blindfolded? With temptations at every turn and endless options vying for our attention, it's easy to lose sight of our long-term financial well-being and make snap decisions. But fear not! By adopting a few simple habits, you can become a smart spender, enjoying the present moment while paving the way to a healthy financial future. Here are seven to get you started!

Does the ritual of gathering documents and navigating the complex maze of tax laws stress you out every year? You’re not alone. If you want to avoid tax season anxiety, careful planning is the best way to do so. This blog outlines multiple tips and strategies to help you streamline your process, confidently tackle tax season, and achieve peace of mind.

Over time, we have all become generally smarter about identifying and avoiding cyber threats. Unfortunately, scammers and hackers have become more creative with their deceptive techniques in response to society's increasing awareness of their activities. Therefore, it is important to still take cybersecurity issues seriously. You must diligently review communications and look for telltale signs of fraud. Keep reading to learn how to recognize these early on!

Do you have a hard time discussing finances? You’re not alone. This topic has historically been somewhat taboo and even though Gen Z has already significantly shifted societal conversations to be more open, for some reason many people of all generations still struggle to speak up about money.

There has been a lot of hype about self-driving cars. But when, realistically, can we expect to be driven to our destination by a vehicle that has no steering wheel, gas pedal, or seat specifically designated for a driver? In 2021, self-driving cabs hit the roads in select test cities. Companies like Waymo, Tesla, and Uber have been actively involved in autonomous taxi development, but this service is still not commonly available in most places.

Bonds are commonly considered poor investments when rates are on the rise. But is that really a fair assessment? This blog will address misconceptions about bonds.

A new vehicle can be one of the biggest financial expenses you face, which is why you must explore your options before you make your final decision. When you break it down, there are really only two routes you can take: buy or lease. So the question is, which option better suits your lifestyle?

It’s one of the hardest jobs you will ever do, and you may never actually get any true credit for it: single parenting. Since the 1960s, there has been a clear jump in the number of children living in a single-parent home. According to the United States Census Bureau, between 1960 and 2016, the amount of children living in with two parents decreased from 88% to 69%. It is reported that this was caused by an increase of births to unmarried women and an increase in divorces among couples. In 2010 alone, 40.7% of all births in the U.S. were to unmarried women. The latest Census data shows that approximately 26% of children live in single-parent households today.

Why Diversified Portfolios Should Be Invested Abroad

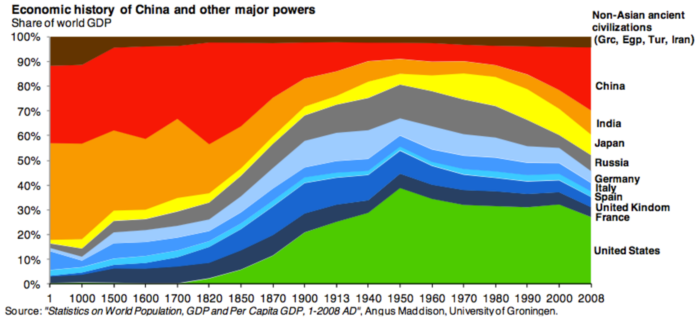

If you want to see global economic history in a single colorful graph, keep reading. The following was produced by The Atlantic magazine and it shows the share of global GDP for various countries from the year 1 AD to 2008 AD.

.png)

.png?width=440&height=102&name=Wealth%20Conservatory%20Logo%20(1).png)