There are many types of financial professionals. All the titles and accreditations can be very confusing; and the last thing you want to feel when putting your finances into someone else’s hands is confusion. To put your mind at ease, we’ve created an eBook that thoroughly explains what the title “financial planner” means and why you might benefit from working with one yourself. Simply put, a financial planner is a professional who helps you assess your current situation so they can then strategize actionable ways to achieve your long-term goals.

It’s natural to react to market, economic, and geo-political turmoil in the moment. This is a common mistake to make.

With the internet at your fingertips, you can become an expert at anything, right? That’s not exactly true. A little knowledge can lead to a lot of harm if research and implementation are not done responsibly. First, you want to be sure to consult resources that you can trust.

When the 2917 Tax Cuts and Jobs Act raised the standard deduction for taxpayers to $24,000 for couples ($12,000 for singles), and lowered individual tax rates, an unintended consequence was to reduce the tax benefits of making charitable donations. Fewer taxpayers were itemizing, which means their donations didn’t count as deductions. Itemizing taxpayers – including people who intentionally raised their level of giving in order to cross the standard deduction threshold – found that the lower brackets reduced their tax benefits.

You may have read that the Social Security Trust Fund is due to be depleted in 2033, a year earlier than previous projections. This sounds alarming, except for several caveats.

If you look at finance magazines and websites you’ll see headlines such as, “10 Dividend Growth Stocks You Can Count On” (Kiplinger), or “20 Dividend Growth Stocks Blasting Off” (Forbes). There’s an annual “Dividend Aristocrats” list of 65 companies, and occasional articles telling retirees that they should buy stocks so they can live off of the dividend checks.

Ah, the heady times when markets just keep rising as if to the moon. It is exhilarating, isn’t it?

There’s a lot of buzz in the investment world about Bitcoin—and cryptocurrencies in general. Is it an investment? A real medium of exchange? Some of this interest undoubtedly comes from the fact that, in 2009, Bitcoins were selling for eight cents a coin. At the peak earlier this year, one of those coins was trading at $65,000.

These days it seems like reading is becoming a thing of the past, what with podcasts, TED Talks, and YouTube videos becoming more popular vectors of information and entertainment. But a growing body of scientific literature suggests that reading actual books may be more important than we realize for enhancing certain parts of our brains and delaying the onset of dementia.

Loans and credit cards all sound like a dream come true when you first hit some level of financial awareness. Many young adults have thought, “Am I about to be handed free money?” That’s before they have a true understanding of what it means to be in debt.

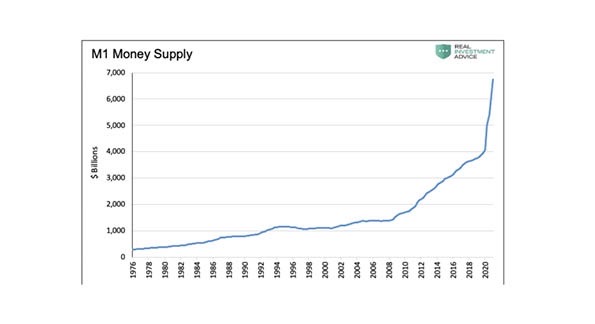

Conventional economics tells us something that would seem to be obvious: when the government creates more money, there is more money available to buy things, and therefore the prices of things rise—and we get inflation. For some reason, this logical sequence of events seems not to be happening today. The amount of money in the U.S. economy is 25% higher than it was at the start of 2020—the fastest pace of growth since the U.S. Federal Reserve banking system was established in 1913. You can see from the chart that we have experienced steady growth of the money supply until around 2009, when the slope increased (remember the Great Recession?), and then in early 2020 the growth of dollars in the system made another dramatic shift upwards.

If you could live in any U.S. state, which one would let you keep more of your money than others? The answer turns out to be surprisingly complicated…

.png)

.png?width=440&height=102&name=Wealth%20Conservatory%20Logo%20(1).png)