Giving to a charity is easy, so they say. You write a check and send it off to your favorite 501(c)(3) organization. Come tax time, if you itemize, you may be able to deduct the amount (often up to 60%) of your adjusted gross income for cash gifts to qualified charities (though limits can be lower depending on the type of contribution and recipient).

Jay Hutchins

Jargon is wonderful when it applies to your profession but is not so enduring when it applies to someone else’s. I am surrounded in my family by medical professionals and engineers. So, one can only imagine the conversations around my house flying over the head of a financial planner. However, my industry jargon can confuse clients of financial services. In this blog, I will shed some light on a significant word that gets used quite often but remains shrouded in mystery for some: fiduciary.

Over time, we have all become generally smarter about identifying and avoiding cyber threats. Unfortunately, scammers and hackers have become more creative with their deceptive techniques in response to society's increasing awareness of their activities. Therefore, it is important to still take cybersecurity issues seriously. You must diligently review communications and look for telltale signs of fraud. Keep reading to learn how to recognize these early on!

There has been a lot of hype about self-driving cars. But when, realistically, can we expect to be driven to our destination by a vehicle that has no steering wheel, gas pedal, or seat specifically designated for a driver? In 2021, self-driving cabs hit the roads in select test cities. Companies like Waymo, Tesla, and Uber have been actively involved in autonomous taxi development, but this service is still not commonly available in most places.

Bonds are commonly considered poor investments when rates are on the rise. But is that really a fair assessment? This blog will address misconceptions about bonds.

Why Diversified Portfolios Should Be Invested Abroad

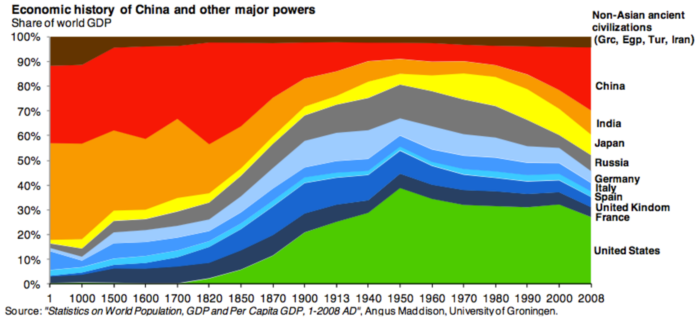

If you want to see global economic history in a single colorful graph, keep reading. The following was produced by The Atlantic magazine and it shows the share of global GDP for various countries from the year 1 AD to 2008 AD.

It’s natural to react to market, economic, and geo-political turmoil in the moment. This is a common mistake to make.

When the 2917 Tax Cuts and Jobs Act raised the standard deduction for taxpayers to $24,000 for couples ($12,000 for singles), and lowered individual tax rates, an unintended consequence was to reduce the tax benefits of making charitable donations. Fewer taxpayers were itemizing, which means their donations didn’t count as deductions. Itemizing taxpayers – including people who intentionally raised their level of giving in order to cross the standard deduction threshold – found that the lower brackets reduced their tax benefits.

You may have read that the Social Security Trust Fund is due to be depleted in 2033, a year earlier than previous projections. This sounds alarming, except for several caveats.

If you look at finance magazines and websites you’ll see headlines such as, “10 Dividend Growth Stocks You Can Count On” (Kiplinger), or “20 Dividend Growth Stocks Blasting Off” (Forbes). There’s an annual “Dividend Aristocrats” list of 65 companies, and occasional articles telling retirees that they should buy stocks so they can live off of the dividend checks.

Ah, the heady times when markets just keep rising as if to the moon. It is exhilarating, isn’t it?

There’s a lot of buzz in the investment world about Bitcoin—and cryptocurrencies in general. Is it an investment? A real medium of exchange? Some of this interest undoubtedly comes from the fact that, in 2009, Bitcoins were selling for eight cents a coin. At the peak earlier this year, one of those coins was trading at $65,000.

.png)

.png?width=440&height=102&name=Wealth%20Conservatory%20Logo%20(1).png)