Did you know that Albert Einstein once referred to compounding interest as the eighth wonder of the world? If you’re not familiar with this financial term, Einstein’s fondness for it might surprise you. The word “interest” can trigger some negative emotions because it’s often associated with others charging you interest on a debt, but don’t forget that you can also earn interest through your savings and investments.

Savings, investments, and the interest you earn on them are crucially important to your retirement plan. According to Forbes, many Americans approaching retirement age are failing to save the funds they'll need. A study commissioned by the investment firm Schroders states that only 40% of respondents think they have enough money for retirement, 45% said their expenses in retirement are higher than expected, and 62% have “no idea” how long their savings will last.

To avoid the anxieties that many of these study respondents are reporting, it’s important to take matters into your own hands when you can because there is so much out of our control, such as the future of Social Security, inflation, the rising costs of healthcare, and possible market downturns. Thankfully, the magic of compounding interest can help you prepare for retirement, with minimal effort and investment!

What’s so special about compounding interest anyway?

You may be familiar with simple interest, which is calculated based on only your initial investment. With compounding interest, you earn interest not only on the principal amount but on any previous interest you’ve accrued as well. This allows your wealth to grow exponentially.

When should I start saving for retirement to take full advantage of compounding interest?

Now! When it comes to saving for retirement, the more time you give yourself, the better. That means if you’re young, it’s not too early to start, and if you’re already approaching retirement, it’s not too late. No matter where you are in your journey, the answer to when to act is now. Of course, the younger you are when you start saving, the less income you may be bringing home, and therefore the less you may be able to afford to put away. However, even if you feel like what you are putting into an account with compounding interest is insignificant, it really isn’t, as it will exponentially grow over time.

I’m sorry, I still don’t really get how compounding interest works and why it’s so important to start saving for retirement at a young age... Can you give me an example?

With compounding interest, the earlier you start saving for retirement, the less overall funds you’ll have to contribute. An initial investment you might consider modest can add up to a large sum over time, even if you stop contributing money at some point. However, starting to save early and continuing to make consistent deposits is the ultimate combination. Here's an example from Money Under 30 that shows why this is true…

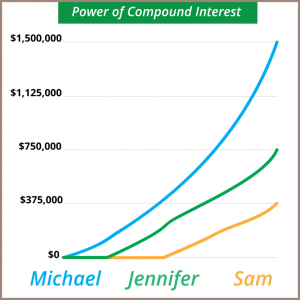

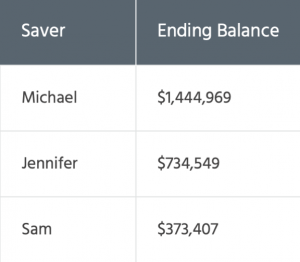

The graph plots the savings strategies of three fictional investors, each of whom saved $1,000 per month over a 10-year term with an average annual return of 7%. None of the three made any withdrawals until they reached age 65. However, Michael started saving at 25, Jennifer started at 35, and Sam didn’t start until he was 45.

The chart shows how this simple difference in the age at which these fictional individuals started saving resulted in their ending balances being dramatically different. This is because of compounding interest. The reason Michael’s ending balance is so large is that his investments had decades to accrue interest on both his principal and on a significant amount of past interest because he started so young.

Oh, I see! So, how exactly do I start saving for retirement in a way that will make compounding interest work for me?

There are a variety of answers to this question...

- If the company you work for has an employer-sponsored 401(k), definitely start contributing to that. These are especially great when the company matches what you put into the account to some extent because that’s basically free money!

- If you’re self-employed, consider setting up a retirement plan (ex. Solo(k), SEP IRA, or SIMPLE IRA) for you and anyone else you employ.

- You could also open a Traditional or Roth IRA if you're eligible. Traditional IRAs are pre-tax, which means you won’t pay taxes on that money until you begin taking distributions later in life.

Funds going into a Roth IRA are after-tax dollars, but at least the earnings in the account grow tax-free. If you go with a Roth, consider maxing it out (depositing as much as you can based on the mandated limit that year). This is a great way to take advantage of compounding interest, since that big chunk of money can sit there and grow while you stop or slow your contributions altogether.

To learn more about which type of retirement account is right for you, contact your financial advisor. They’re just the right people to help you navigate through this whole process in a personalized manner. However, there are plenty of online calculators that can help you assess compounding interest rates, such as Investor.gov, Financial-Calculators.com, and TheCalculatorSite.com. Whichever action you decide to take to make sure you’re on the path to a great retirement, make sure you do it as soon as possible! Time is your secret weapon when it comes to battling financial anxieties and making compounding interest work for you.

.png)

.png?width=440&height=102&name=Wealth%20Conservatory%20Logo%20(1).png)