The initials ESG refer to the factors used to measure the environmental and ethical impact of investing in a company. The “G” stands for governance, corporate governance to be exact. A trend within the group of investors who care about the systems, structures and policies governing a corporation is investing in more women-owned and women-led businesses.

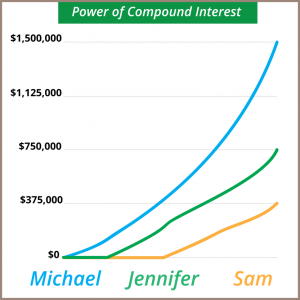

Did you know that Albert Einstein once referred to compounding interest as “the eighth world wonder?” If you’re not familiar with this financial term, Einstein’s fondness for it might surprise you. The word “interest” can trigger some negative emotions because it’s often associated with others charging you interest on a debt, but don’t forget that you can also earn interest through your savings and investments.

The wide world of investment is full of opportunities. Unfortunately, along with these opportunities comes a lot of jargon and confusion. Common questions that people ask themselves are “What are mutual funds?” and “Should I invest in mutual funds?” Like most things in life, there are pros and cons to doing so. This breakdown will cut through the buzzwords so that you can get a better idea of what mutual funds are and whether or not investing in them is a good financial fit for you.

You may have read that the U.S. Federal Reserve Board, which has unlimited financial resources, is now buying ETFs. With the Fed’s $4.75 trillion in assets significantly larger than your own retirement portfolio, it seems fair to ask: does it make sense for a government agency to be buying investments alongside retail investors?

Financial planning is the process of assessing a person's current money situation and long-term monetary goals, as well as coming up with actionable ways to achieve those quantifiable goals. The process of financial planning is very comprehensive and requires the examination of spending habits, savings, emergency accounts, investments, insurance needs, retirement plans, and other projected future expenses. Once this information is collected, it is reviewed and analyzed.

The Coronavirus Aid, Relief and Economic Security (CARES) Act was enacted on March, 27th. It is intended to be federal government support in the wake of the coronavirus public health crisis and associated economic fallout. The CARES Act is built on the two former pieces of legislation and is meant to provide more robust support to both individuals and businesses, including changes to tax policy. Here are 8 aspects of this pandemic relief measure that are important to take note of…

Investors of a certain age, with long memories, remember the prelude to the Tech Wreck of 2000. Back then, even investors in the supposedly diversified S&P 500 index of 500 stocks discovered that they were 33% invested in technology. By 2003, after a murderous series of downturns that saw a number of tech companies go out of business, that weighting had fallen back to 14% of the index.

Every year, we hear from market prognosticators telling us where the market will be a year from now, the future direction of interest rates and when the economy will or won’t go into recession. But does anybody ever keep track of the accuracy of these forecasts?

You may be aware that on December 20, President Trump signed something called the SECURE Act (Setting Every Community Up for Retirement Enhancement) into law. But what does that mean for financial consumers? Among other things, the new law increases the tax credit for small businesses to set up new retirement plans for their employees, from $500 to $5,000. It allows small employers to automatically enroll their employees and allows smaller companies to create multiple employer plans with other companies in the area, reducing the obstacles to offering 401(k) and other retirement plans. A great deal of insurance industry lobbying support went into another provision that requires all qualified plans to show participants how they can convert their existing balances into “lifetime income” through an annuity.

One of the oddities about the American financial marketplace is how so many consumers prefer to keep their assets at the large Wall Street firms. This is odd because these firms famously have sales cultures driven by multi-million-dollar bonuses for their brokerage sales agents and whose BrokerCheck reports read more like rap sheets than profiles. (Don’t believe us? Type a famous brokerage firm name into the second box in the BrokerCheck website—https://brokercheck.finra.org/—and you’ll get hundreds of thousands of listings of specific broker transgressions, fines, and examples where customers received arbitration awards after various kinds of financial abuse.)

Estate planning is complicated. There are many moving parts to organizing your finances and determining where they will go after your passing. People often sign a stack of documents at their attorney’s office and think the job is done.

.png)

.png?width=440&height=102&name=Wealth%20Conservatory%20Logo%20(1).png)