Does managing your finances ever feel like navigating a maze blindfolded? With temptations at every turn and endless options vying for our attention, it's easy to lose sight of our long-term financial well-being and make snap decisions. But fear not! By adopting a few simple habits, you can become a smart spender, enjoying the present moment while paving the way to a healthy financial future. Here are seven to get you started!

Clara Moses

Does the ritual of gathering documents and navigating the complex maze of tax laws stress you out every year? You’re not alone. If you want to avoid tax season anxiety, careful planning is the best way to do so. This blog outlines multiple tips and strategies to help you streamline your process, confidently tackle tax season, and achieve peace of mind.

Do you have a hard time discussing finances? You’re not alone. This topic has historically been somewhat taboo and even though Gen Z has already significantly shifted societal conversations to be more open, for some reason many people of all generations still struggle to speak up about money.

There are many types of financial professionals. All the titles and accreditations can be very confusing; and the last thing you want to feel when putting your finances into someone else’s hands is confusion. To put your mind at ease, we’ve created an eBook that thoroughly explains what the title “financial planner” means and why you might benefit from working with one yourself. Simply put, a financial planner is a professional who helps you assess your current situation so they can then strategize actionable ways to achieve your long-term goals.

With the internet at your fingertips, you can become an expert at anything, right? That’s not exactly true. A little knowledge can lead to a lot of harm if research and implementation are not done responsibly. First, you want to be sure to consult resources that you can trust.

Loans and credit cards all sound like a dream come true when you first hit some level of financial awareness. Many young adults have thought, “Am I about to be handed free money?” That’s before they have a true understanding of what it means to be in debt.

The initials ESG refer to the factors used to measure the environmental and ethical impact of investing in a company. The “G” stands for governance, corporate governance to be exact. A trend within the group of investors who care about the systems, structures and policies governing a corporation is investing in more women-owned and women-led businesses.

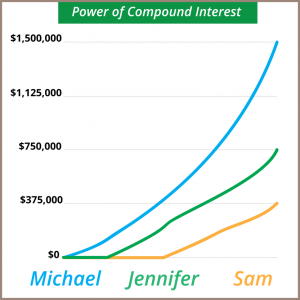

Did you know that Albert Einstein once referred to compounding interest as “the eighth world wonder?” If you’re not familiar with this financial term, Einstein’s fondness for it might surprise you. The word “interest” can trigger some negative emotions because it’s often associated with others charging you interest on a debt, but don’t forget that you can also earn interest through your savings and investments.

The wide world of investment is full of opportunities. Unfortunately, along with these opportunities comes a lot of jargon and confusion. Common questions that people ask themselves are “What are mutual funds?” and “Should I invest in mutual funds?” Like most things in life, there are pros and cons to doing so. This breakdown will cut through the buzzwords so that you can get a better idea of what mutual funds are and whether or not investing in them is a good financial fit for you.

Financial planning is the process of assessing a person's current money situation and long-term monetary goals, as well as coming up with actionable ways to achieve those quantifiable goals. The process of financial planning is very comprehensive and requires the examination of spending habits, savings, emergency accounts, investments, insurance needs, retirement plans, and other projected future expenses. Once this information is collected, it is reviewed and analyzed.

.png)

.png?width=440&height=102&name=Wealth%20Conservatory%20Logo%20(1).png)