When it comes to Medicare, one thing that many people agree on is that the enrollment process isn’t completely straightforward. Correct, helpful information is out there, but it’s often buried under jargon, lengthy articles, and conflicting sources. If you feel like your 65th birthday is approaching with gaining speed and you’re still confused about what exactly that entails, read this blog for answers to some of the most frequently asked Medicare questions.

Is It Mandatory to Sign Up for Medicare at Age 65?

Saving money is a daunting task for many people. Whether it seems like you need all your funds just to cover regular expenses or you struggle with resisting the urge to spend your extra cash, you’re not alone. According to Forbes, the U.S. personal savings rate has been falling for most of 2021 and 2022. However, considering the increases in inflation and interest rates, right now is the perfect time to focus on padding your savings for unexpected expenses. The good news is saving really does not need to be painful. If you’re going into 2023 looking for more ways to save, keep reading for 10 practical tips.

Topics: saving

It’s one of the hardest jobs you will ever do, and you may never actually get any true credit for it: single parenting. Since the 1960s, there has been a clear jump in the number of children living in a single-parent home. According to the United States Census Bureau, between 1960 and 2016, the amount of children living in with two parents decreased from 88% to 69%. It is reported that this was caused by an increase of births to unmarried women and an increase in divorces among couples. In 2010 alone, 40.7% of all births in the U.S. were to unmarried women. The latest Census data shows that approximately 26% of children live in single-parent households today.

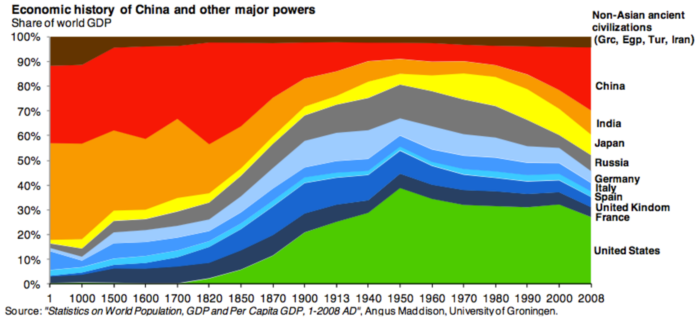

Why Diversified Portfolios Should Be Invested Abroad

If you want to see global economic history in a single colorful graph, keep reading. The following was produced by The Atlantic magazine and it shows the share of global GDP for various countries from the year 1 AD to 2008 AD.

Topics: wealth, retirement, social security, saving, live longer, money

Standards of Care in the Finance Industry: Fiduciary vs. Best Interest

There is a wide variety of financial professionals out there, and although there is some crossover between the responsibilities that fall under each title, one key difference is that they are not all governed by the same standards. The various titles and standards can be confusing, especially for people who have never worked with a professional before. This can make the process or finding help even more daunting for beginners who may already be hesitant about letting someone else handle their money. If you’re in that boat, look for a fiduciary financial advisor. You can confidently trust these professionals, and here’s why…

Topics: fiduciary

There are many types of financial professionals. All the titles and accreditations can be very confusing; and the last thing you want to feel when putting your finances into someone else’s hands is confusion. To put your mind at ease, we’ve created an eBook that thoroughly explains what the title “financial planner” means and why you might benefit from working with one yourself. Simply put, a financial planner is a professional who helps you assess your current situation so they can then strategize actionable ways to achieve your long-term goals.

Topics: financial planning

It’s natural to react to market, economic, and geo-political turmoil in the moment. This is a common mistake to make.

With the internet at your fingertips, you can become an expert at anything, right? That’s not exactly true. A little knowledge can lead to a lot of harm if research and implementation are not done responsibly. First, you want to be sure to consult resources that you can trust.

When the 2917 Tax Cuts and Jobs Act raised the standard deduction for taxpayers to $24,000 for couples ($12,000 for singles), and lowered individual tax rates, an unintended consequence was to reduce the tax benefits of making charitable donations. Fewer taxpayers were itemizing, which means their donations didn’t count as deductions. Itemizing taxpayers – including people who intentionally raised their level of giving in order to cross the standard deduction threshold – found that the lower brackets reduced their tax benefits.

You may have read that the Social Security Trust Fund is due to be depleted in 2033, a year earlier than previous projections. This sounds alarming, except for several caveats.